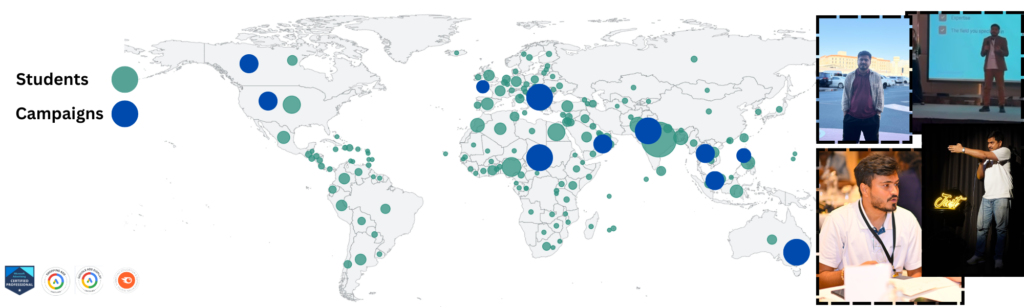

I am Abdullah, advisor and coach.

Based in the UAE, with a focus on financial metrics, I am a global marketing advisor and coach. 17 years, 45K students, Fortune 500 clients, and startups have taken my advice successfully. If you feel stuck in sales and marketing, then I am the right guy to talk to.

01.

Training: Curiosity is not enough. I teach REAL KNOWLEGE not easy to Find on the Internet.

Training

02.

1 on 1: I provide private consultancy on marketing, sales, product development and investment matters. You can book 1 hour or more.

Me Speaking at Events

AdTech/MarTech Stacks

Automation

AI Ecosystems

Multiple LLMs

AI Studio

Vibe Code

Ad Networks

my

experience

17+

Years of Experience

45K+

Students

100+

Clients

Major Ones

testimonials

my students say

Great course with applicable strategies on SEO Content Writing

Bassit Olamide

SEO Content Training

Because it is stay on my own experience.

Ayub Khudhur

Pricing Strategy Training

It is absolutely mind blowing.

Afra Qadeer Khan

Technical SEO Training

It was a lovely course. Keep it up! Thanks, and best of luck to you!

Laibra Abdul Manan

Company SEO

Good Lessons, Thank you very much!

Dannaruwalage Piumal

Data Studio Training

“I learned full digital marketing in less than 30 days. Yes, there is more, but I have more knowledge than regular one year employee even though I am a beginner.”

Kate Johnson

Company SEO

anything on mind?

contact me

latest from the blog

latest news

December 23, 2024

How to Increase Your ROI Through scientific SEM?

September 2, 2022

Share Your Images & Be Featured

September 2, 2022

AMAZING Natural Light Portraits in a Garage?

December 23, 2024